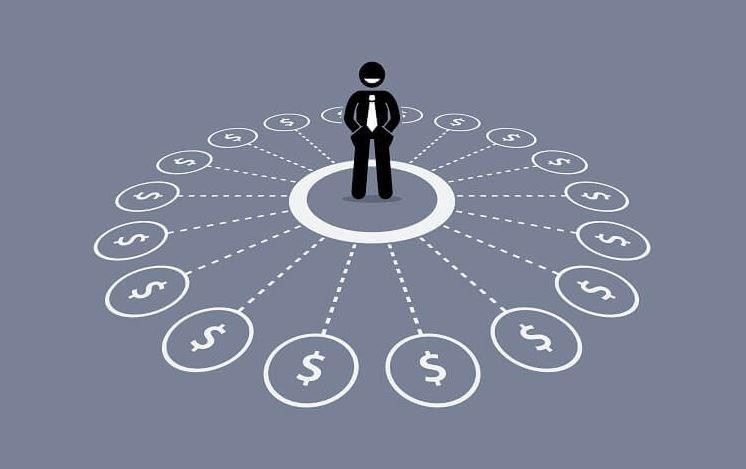

In today’s ever-changing economic landscape, relying on a single source of income can be risky. Building multiple income streams is a smart strategy for diversifying your wealth portfolio, providing financial stability, and increasing your overall wealth. This article will delve into the importance of having multiple income streams, explore various income-generating strategies, and offer practical tips on how to implement them effectively. By the end of this guide, you’ll have a clear understanding of how to diversify your wealth portfolio and create a more secure financial future.

Understanding Income Streams

Income streams refer to the various sources of income you can generate, which can be classified into two main categories: active income and passive income.

- Active Income: This is the income you earn through direct involvement in work, such as a salary from your job, freelance work, or consulting. Active income requires your time and effort and typically ceases if you stop working.

- Passive Income: This income is earned with little to no effort on your part once the initial work is completed. Passive income streams can come from investments, rental properties, royalties, or business ventures that operate independently.

Diversifying your income streams means creating a balance between active and passive income, ensuring that you have a safety net in case one source of income is affected by economic downturns or personal circumstances.

The Importance of Diversifying Income Streams

- Financial Security: Having multiple income streams reduces reliance on a single source of income, providing a safety net during unforeseen circumstances such as job loss or economic downturns. This financial cushion can help you manage expenses and maintain your standard of living.

- Increased Earning Potential: By diversifying your income sources, you can significantly increase your overall earnings. This allows you to save more, invest in your future, and achieve your financial goals more quickly.

- Hedging Against Inflation: Different income streams can react differently to economic changes. For instance, while wages may stagnate, rental income or investment returns may continue to grow, helping you maintain your purchasing power.

- Opportunities for Growth: Diversification can open doors to new opportunities, skills, and experiences. By exploring various income-generating avenues, you may discover new interests or entrepreneurial ventures that could further enhance your wealth.

Strategies for Building Multiple Income Streams

1. Start a Side Hustle

A side hustle is an excellent way to generate extra income while pursuing your passions or interests. Consider leveraging your skills or hobbies to create a side business. Here are a few ideas:

- Freelancing: Offer your expertise in writing, graphic design, web development, or consulting on platforms like Upwork, Fiverr, or Freelancer.

- E-commerce: Start an online store using platforms like Shopify or Etsy to sell handmade crafts, digital products, or dropshipping goods.

- Tutoring or Teaching: If you have knowledge in a specific subject, consider offering tutoring services or creating an online course through platforms like Udemy or Teachable.

2. Investing in Stocks and Bonds

Investing in the stock market is one of the most common ways to build wealth over time. By purchasing shares of companies, you can earn dividends and benefit from capital appreciation.

- Stocks: Look for dividend-paying stocks, which can provide a steady stream of passive income through regular dividend payments.

- Bonds: Consider investing in government or corporate bonds, which can offer regular interest payments and lower risk compared to stocks.

3. Real Estate Investing

Investing in real estate can be a lucrative way to build wealth and generate passive income. Here are a few real estate strategies:

- Rental Properties: Purchasing rental properties can provide a steady cash flow through monthly rent payments. Ensure you conduct thorough market research and property management to maximize your investment.

- Real Estate Investment Trusts (REITs): If you prefer a more hands-off approach, consider investing in REITs, which allow you to invest in real estate without directly owning properties. REITs pay dividends and are traded like stocks.

4. Create and Sell Digital Products

The digital marketplace is booming, and creating digital products can provide a source of passive income. Consider the following options:

- E-books: Write and self-publish an e-book on a topic you’re knowledgeable about. Platforms like Amazon Kindle Direct Publishing make it easy to reach a wide audience.

- Online Courses: Share your expertise by creating an online course. Use platforms like Skillshare or Coursera to host and market your course.

- Stock Photography: If you’re skilled in photography, consider selling your photos on stock photography sites like Shutterstock or Adobe Stock.

5. Develop a Mobile App or Software

If you have programming skills, consider developing a mobile app or software that solves a problem or meets a need in the market. Once created, you can monetize it through ads, subscriptions, or one-time purchases.

6. Start a Blog or YouTube Channel

Creating content through a blog or YouTube channel can generate income through advertising, sponsorships, and affiliate marketing.

- Blogging: Start a blog on a niche topic that interests you. Use platforms like WordPress or Medium to publish your content. Monetize your blog through affiliate marketing, sponsored posts, and ads.

- YouTube: Create engaging video content and monetize it through ad revenue, sponsorships, and affiliate marketing.

7. Participate in Peer-to-Peer Lending

Peer-to-peer lending platforms like LendingClub or Prosper allow you to lend money to individuals or small businesses in exchange for interest payments. This can be a way to earn passive income while helping others.

8. Build a Niche Website

Consider creating a niche website that targets a specific audience or interest. Use affiliate marketing to earn commissions by promoting products or services related to your niche.

Tips for Successfully Diversifying Your Income Streams

1. Start Small

When exploring new income streams, start small and gradually expand your efforts. This approach minimizes risk and allows you to learn as you go without overwhelming yourself.

2. Leverage Your Existing Skills

Consider what skills or expertise you already possess that can be turned into income-generating opportunities. This could be a more efficient way to develop new income streams.

3. Stay Organized

Managing multiple income streams can be complex. Use budgeting apps or spreadsheets to track your income, expenses, and investments. This will help you stay on top of your financial goals.

4. Network and Collaborate

Networking with others in your field can lead to valuable partnerships and opportunities. Attend industry events, join online forums, and connect with like-minded individuals to expand your reach.

5. Be Patient and Persistent

Building multiple income streams takes time and effort. Be patient and persistent, and don’t be discouraged by initial setbacks. With dedication and hard work, you can achieve your financial goals.

Common Mistakes to Avoid

- Neglecting Your Primary Income Source: While it’s important to diversify, don’t ignore your primary source of income. Ensure you maintain your job performance to avoid jeopardizing your main revenue stream.

- Overextending Yourself: Taking on too many income-generating activities at once can lead to burnout. Be mindful of your time and energy, and focus on quality over quantity.

- Failing to Research: Before diving into a new income stream, conduct thorough research to understand the market, potential risks, and rewards. Knowledge is crucial to making informed decisions.

- Ignoring Taxes: Multiple income streams can complicate your tax situation. Keep track of your income and consult a tax professional to ensure you’re compliant and maximizing your deductions.

Conclusion

Building multiple income streams is a powerful strategy for diversifying your wealth portfolio and achieving financial security. By leveraging various opportunities—such as side hustles, investments, real estate, and digital products—you can create a robust financial foundation that withstands economic uncertainties. Remember to start small, stay organized, and continuously educate yourself on best practices. With dedication and the right approach, you can enjoy the benefits of a diversified income portfolio and work towards a more secure financial future. Start today, and take the first step towards building your wealth through diverse income streams!